How payments work

So you're ready to launch your eCommerce business but not quite sure how the payment process works? Here's what you need to know.

All our plans include:

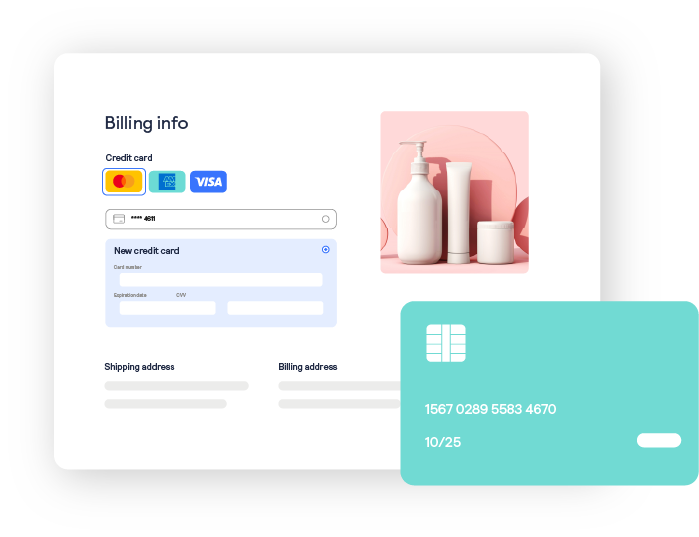

Multiple payment types

Making it easy for customers to use their preferred payment methods, including credit cards, debit cards, and digital wallets.

Advanced Fraud Detection Suite (AFDS)

Advanced Fraud Detection Suite can protect your business by helping to identify, manage and prevent suspicious and potentially fraudulent payment transactions.1

Customer Information Manager (CIM)

Customer Information Manager (CIM) streamlines checkout for returning customers by enabling them to buy without re-entering their payment details.1

Automated Recurring Billing

Automated Recurring Billing allows you to accept and submit monthly recurring or installment payments.

Digital Invoicing

Digital Invoicing saves time by enabling you to issue digital rather than paper invoices.

Simple Checkout

Simple Checkout lets you easily add a Buy Now or Donate button to your website.

You can add these options to your plan:

Account Updater

Account Updater helps avoid payment interruptions and lost sales by automatically updating credit card data in CIM profiles and Automated Recurring Billing subscriptions.

1 May be subject to a charge in the future.

An ally you can trust

Choosing the right allies to provide your payment gateway and merchant bank account will be a critical decision as you build your business.

The good news is, you're not alone. Authorize.net is here to help you navigate your payment gateway and merchant bank account decisions, recommend further solutions, and provide you with whatever additional expertise and answers you need.