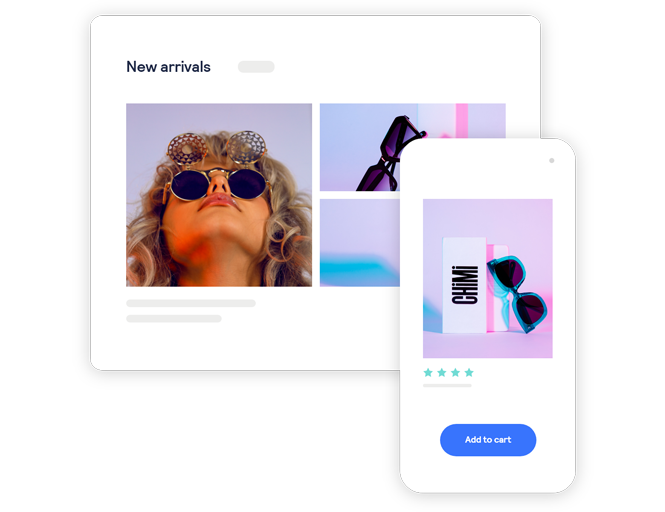

Have a clear “call to action”

The building blocks of a successful online business

Online businesses come in all shapes and sizes. But they share a few core components:

Choosing the right payment gateway

Many payment gateways authorize, capture, and settle transactions. But to help your business grow, you may need more than just basic features. Here are a few essential payment gateway capabilities you should look for.

PCI DSS

The Payment Card Industry Data Security Standard (PCI DSS) is a set of security requirements designed to protect cardholder data. As an eCommerce merchant, you're ultimately responsible for understanding and complying with PCI DSS standards. The right payment gateway solution provider can help you address compliance issues.

Secure customer data management

Storing sensitive payment card information on your own servers could increase your data security risks. To minimize those risks, choose a payment solution that securely stores and manages payment information on your behalf. This will also reduce your compliance PCI DSS scope.

Fraud prevention

Insist on a payment gateway solution that actively monitors transactions for fraudulent activity and catches problems before they damage your business.

Look for robust payment solutions

Multiple payment types

In addition to payment cards, your payment solution should accept eChecks and digital wallet services like Apple Pay and PayPal.

Automated payment card updates

When people change their address, or replace an expired, stolen, or lost card, you could miss out on sales. Look for a smart payment solution that monitors your customers’ card information, alerts you to any changes, and automatically updates it.

Recurring payments

If the goods you sell lend themselves to subscription-based sales, consider a solution that supports automated monthly recurring payments.

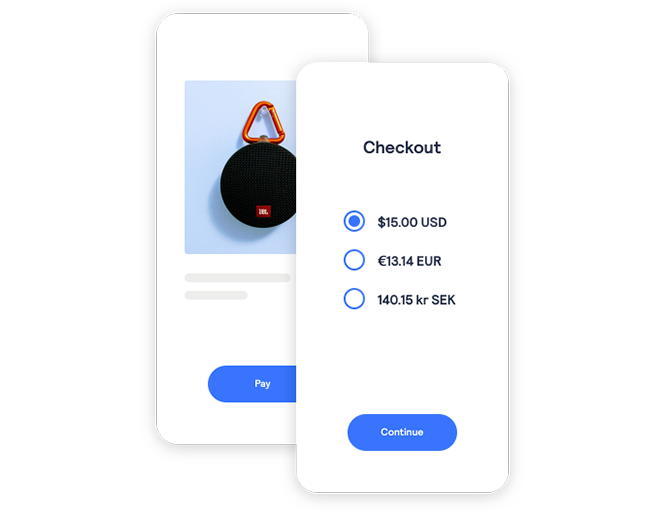

Make shopping easier for your customers

Give returning customers a great experience by enabling them to buy without re-entering their payment details.

Disclaimer: No legal advice intended

This site provides general information related to creating and running a business. The content of this site is for informational purposes only and not for the purpose of providing business, legal or tax advice or opinions. The contents of this site, and the viewing of the information on this site, should not be construed as, and should not be relied upon for business, legal or tax advice in any particular circumstance or fact situation. No action should be taken in reliance on the information contained on this site and Visa Inc. disclaims all liability in respect to actions taken or not taken based on any or all of the contents of this site to the fullest extent permitted by law. You should contact an attorney to obtain advice with respect to any particular business, legal or tax issue or problem, including those relating to your current or potential business.

The contents of this site have been developed for a U.S. audience.

Source: Visa Small Business Hub

A partner you can trust

Choosing the right payment gateway solution provider is one of the most important decisions you’ll make as you build your online business. The good news is, you're not alone. Authorize.net is here to help you navigate your payment processing decision, recommend solutions, and provide you with whatever expertise and answers you need.